Few initiatives in economic policy have sparked as much interest and potential as Opportunity Zones in the United States. These zones, envisioned as catalysts for community development and economic revitalization, offer a unique blend of tax incentives, including Opportunity zones tax benefits, specifically designed to attract investment into designated distressed areas across the country.

Understanding Opportunity Zones

Established under the Tax Cuts and Jobs Act of 2017, Opportunity Zones aims to channel private investment into communities facing economic challenges. These zones are typically low-income census tracts nominated by state governors and certified by the U.S. Department of the Treasury. The overarching goal is to spur economic growth, create jobs, and improve the quality of life for residents in these underserved areas.

Tax Incentives and Benefits

One of the primary draws of Opportunity Zones is the array of tax incentives available to investors who allocate their capital gains into Qualified Opportunity Funds (QOFs). These funds, which invest in businesses or properties within Opportunity Zones, offer several key advantages:

Deferral of Capital Gains Taxes: Investors can defer taxes on capital gains by reinvesting those gains into QOFs within 180 days of realizing the gain. This deferral lasts until the earlier of the date on which the investment in the QOF is sold or exchanged, or December 31, 2026.

Partial Forgiveness of Deferred Gains: Investors who hold QOF investments for at least five years may qualify for a step-up basis on deferred capital gains, which reduces tax liability by 10%. Holding the investment for at least seven years increases this reduction to 15%.

Tax-Free Growth: After investing in the QOF for at least ten years, asset value appreciation is tax-free. This provision encourages long-term investment in these communities, aligning investors’ interests with the goals of sustained economic development.

Geographic Distribution and Community Impact

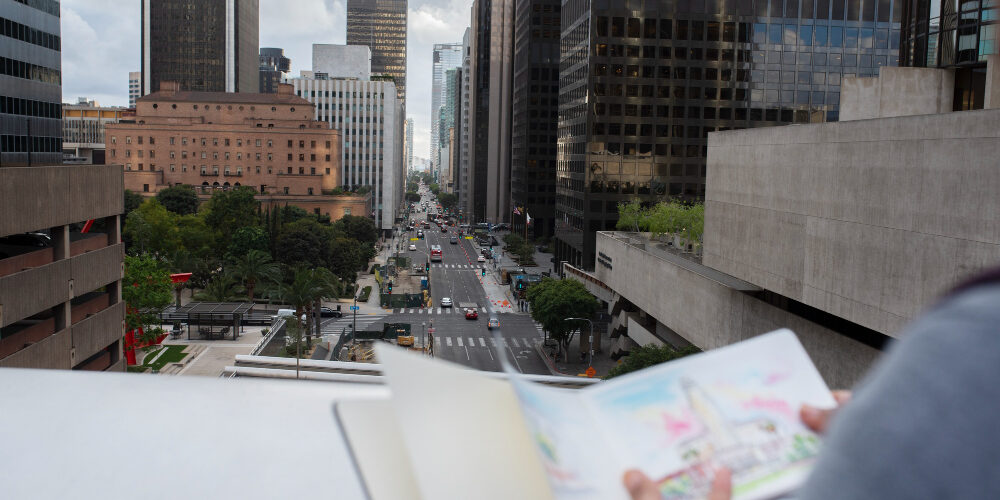

Opportunity zones encompass diverse communities ranging from rural towns to urban centers in all 50 states, the District of Columbia, and several U.S. territories. By selecting these zones based on economic indicators such as household income and poverty rates, investments are directed toward areas most needing revitalization.

The program addresses many economic challenges by attracting capital to these zones, including unemployment, lack of affordable housing, and insufficient infrastructure. Opportunity Zones aims to create sustainable growth that benefits residents and businesses through targeted investments in companies, real estate projects, and infrastructure improvements.

The Expertise of Martin LLP Lawyers

Martin LLP, a prominent law firm specializing in tax and investment law, plays a crucial role in the Opportunity Zones landscape. Their extensive expertise helps navigate the complex regulatory framework surrounding QOFs and ensures compliance with IRS guidelines. They provide valuable counsel to investors and fund managers, offering insights into structuring investments to maximize Opportunity Zones tax benefits while mitigating legal risks. This level of expertise should instill confidence in potential clients, reassuring them that they are in capable hands.

Their involvement extends beyond advisory services; they actively facilitate transactions and partnerships that align with the program’s objectives of fostering economic development. By providing strategic legal advice and transactional support, their lawyers empower stakeholders to make informed decisions that drive positive outcomes in Opportunity Zones nationwide.

Conclusion

As Opportunity Zones evolve, their impact on local economies and communities will become increasingly apparent. The program represents a bold experiment in leveraging private capital to address entrenched economic disparities and create pathways to prosperity for underserved populations.

Opportunity Zones offer investors a compelling opportunity to achieve significant tax benefits and make a positive social impact. By aligning financial incentives with community development objectives, the program promises to unlock new avenues for growth and opportunity, including Opportunity Zones tax benefits, across America’s diverse landscape. This potential for financial gain should inspire and motivate investors to explore the opportunities Opportunity Zones presents.

In the years to come, ongoing evaluation and adaptation of the Opportunity Zones framework will be essential to ensure that it fulfills its intended purpose of fostering inclusive economic growth and improving the quality of life for all Americans.

Through thoughtful investment and strategic planning, Opportunity Zones have the potential to redefine the future of community development in the United States, paving the way for resilient, thriving neighborhoods where every resident can share in the benefits of economic progress.

Explore Opportunity Zones with Martin LLP

Discover how Martin LLP can guide you through the complexities of Opportunity Zones and help you leverage significant tax benefits for your investments. Whether you’re an investor seeking to maximize returns or a fund manager navigating regulatory requirements, their team of experts provides tailored legal solutions and strategic advice.

Visit Martin LLP today to learn more about their services and how they can assist you in achieving your financial goals in Opportunity Zones. Take the first step towards driving positive economic impact while optimizing your tax strategy with Martin LLP by your side.