The release of updated USDA dietary guidelines often signals important changes for food related businesses across the United States. For restaurants, these guidelines do more than influence menus. They shape regulatory expectations, affect operational risk, and create new insurance considerations that many restaurant owners do not immediately recognize.

Understanding the USDA dietary guidelines impact on restaurants is not just about nutrition compliance. It is about protecting operations, managing liability exposure, ensuring staff safety, and maintaining adequate insurance coverage in a shifting regulatory environment. Restaurant owners who fail to adapt may face increased inspection scrutiny, higher claim frequency, or coverage gaps that surface only after a loss occurs.

This guide provides a comprehensive, objective analysis of how the new USDA dietary guidelines influence restaurant operations, compliance responsibilities, and insurance planning. It is written to help restaurant owners and operators make informed decisions while navigating one of the most overlooked regulatory shifts in the food service industry.

Understanding the USDA Dietary Guidelines and Why They Matter to Restaurants

The USDA dietary guidelines are updated periodically to reflect evolving nutritional science and public health priorities. While these guidelines are designed primarily for consumers and institutional food programs, they have a downstream impact on commercial food service operations.

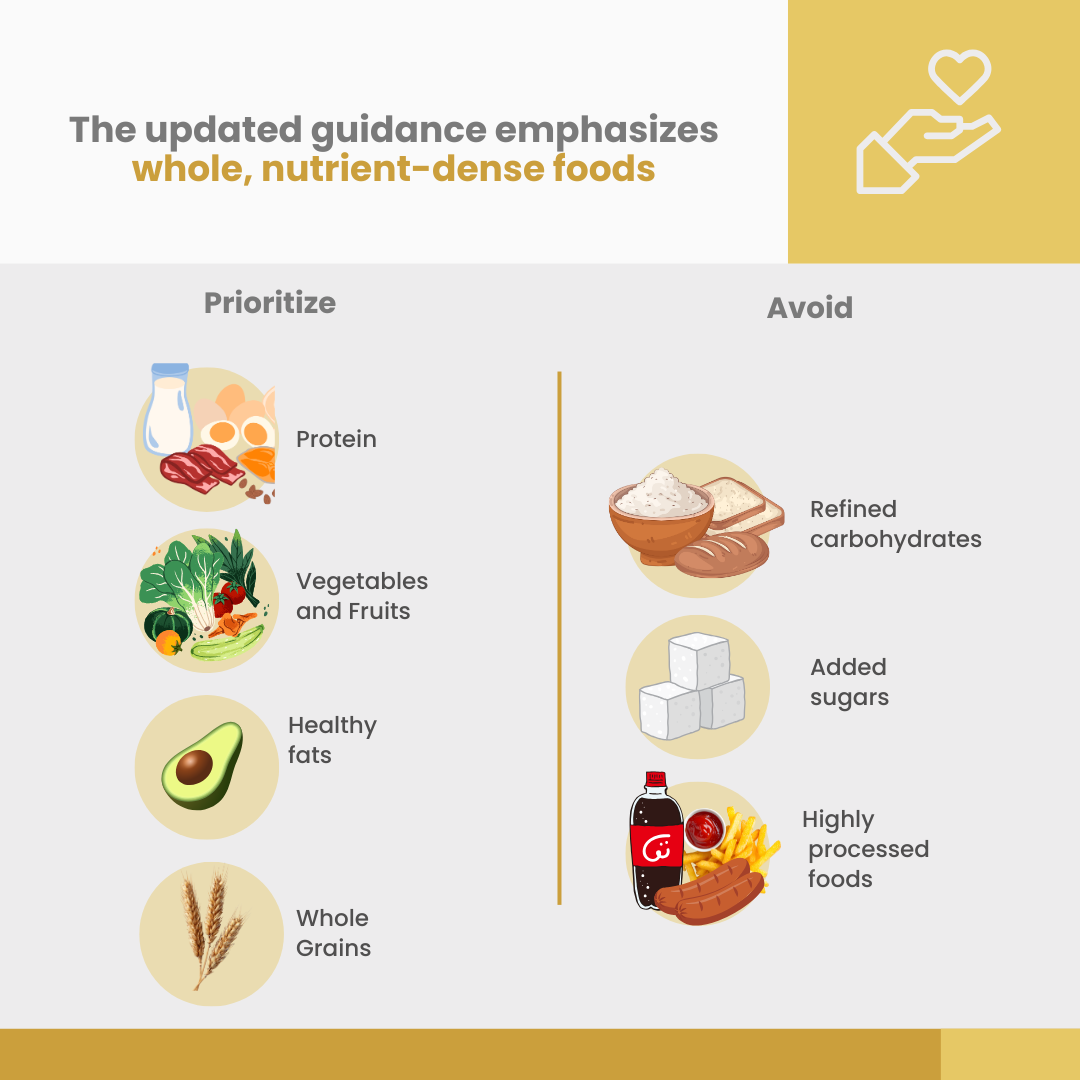

What Changed in the Latest USDA Dietary Guidelines

The most recent updates emphasize reduced added sugars, lower sodium intake, balanced macronutrients, and increased transparency around food sourcing and preparation. There is also stronger language around allergen awareness, portion control, and food quality.

For restaurants, these changes translate into heightened expectations for menu accuracy, ingredient tracking, and staff training. Health inspectors, insurers, and even plaintiffs’ attorneys increasingly reference these guidelines when evaluating whether a restaurant followed reasonable industry standards.

Why Florida Restaurants Face Unique Exposure

Florida restaurants operate in one of the most regulated food service environments in the country. High tourism volume, seasonal staffing, and diverse menus increase operational complexity. When new dietary guidelines become part of the broader regulatory conversation, Florida restaurants often feel the impact faster than operators in less regulated markets.

This environment makes it essential for restaurant owners to understand how compliance intersects with insurance protection.

How USDA Dietary Guideline Changes May Affect Restaurant Costs and Budgets

Implementing menu adjustments to align with new USDA dietary guidelines often has financial implications for restaurants. These changes go beyond ingredient selection and can influence pricing, budgeting, and overall operational expenses.

Ingredient Costs and Sourcing Challenges

Healthier menu options frequently require alternative ingredients such as organic produce, leaner proteins, or specialty grains. These items tend to have higher wholesale costs than conventional ingredients. Seasonal availability and supply chain fluctuations can further increase prices.

Restaurants that source locally or prioritize certified suppliers may face additional logistics costs, including transportation, storage, and inventory management. Even minor menu adjustments, such as reducing sodium through specialty low-sodium products or substituting certain oils, can incrementally raise ingredient expenses.

Menu Pricing Adjustments

Increased ingredient costs often necessitate menu pricing adjustments to maintain profitability. Restaurants must carefully balance affordability for customers with the need to cover rising operational expenses. Sudden price increases may impact customer perception, so many operators employ gradual changes or highlight the value of healthier menu items to justify costs.

Operational Budget Implications

Beyond ingredient costs, compliance with dietary guidelines can affect other aspects of a restaurant’s budget:

- Staff Training: Teaching new cooking techniques or allergen awareness increases labor costs, especially for restaurants with high turnover or seasonal staffing.

- Equipment and Storage: New refrigeration units, prep stations, or specialty appliances may be required to handle fresh or perishable ingredients.

- Waste Management: Adjusting recipes or sourcing new ingredients can result in increased waste during initial implementation phases, affecting both supply costs and environmental sustainability initiatives.

Restaurants that fail to anticipate these budgetary impacts may face reduced margins or unexpected financial strain.

Strategic Planning and Insurance Considerations

Proactive planning helps restaurants manage these financial pressures. Detailed budgeting, supplier negotiations, and menu engineering can minimize the cost impact of compliance. Additionally, reviewing commercial property and equipment insurance ensures that new kitchen investments are protected, reducing the risk of unplanned expenses from equipment failure or spoilage.

Incorporating financial planning into compliance efforts ensures that restaurants remain both profitable and resilient while meeting evolving USDA dietary guidelines.

The USDA Dietary Guidelines Impact on Restaurants From a Risk Perspective

The USDA dietary guidelines impact on restaurants extends beyond menu design. These guidelines influence how risk is evaluated by insurers, regulators, and legal professionals.

Increased Liability Exposure Related to Menu Transparency

As guidelines emphasize nutritional transparency, restaurants face higher expectations to accurately represent ingredients, portion sizes, and preparation methods. Errors or omissions can lead to customer complaints, regulatory citations, or liability claims.

Food allergy related claims remain one of the fastest growing sources of restaurant liability. When guidelines highlight allergen awareness, failure to follow internal protocols can be interpreted as negligence.

Heightened Regulatory Scrutiny

Health departments often align inspection criteria with national dietary guidance. Restaurants that fail to document ingredient sourcing, nutritional changes, or staff training may experience more frequent inspections or corrective actions.

From an insurance perspective, repeated violations can impact underwriting decisions, premiums, and eligibility for certain coverages.

Changing Standards of Care

In liability claims, courts frequently examine whether a business met the accepted standard of care. As USDA guidelines influence industry norms, they indirectly shape how standard of care is defined in food related lawsuits.

Restaurants that lag behind evolving expectations may face greater exposure during claims, especially if insurance policies include exclusions tied to regulatory noncompliance.

Menu Changes and Their Insurance Implications

Menu adjustments driven by new dietary guidelines can trigger insurance related consequences that are often overlooked.

Recipe Modifications and Product Liability Risk

Switching ingredients to reduce sodium, sugar, or fat content may alter food preparation methods. New ingredients can introduce previously unrecognized allergens or contamination risks.

If a customer experiences an adverse reaction, product liability coverage becomes critical. Restaurants must ensure that policy limits and endorsements align with current menu offerings.

Labeling Errors and Advertising Liability

Restaurants that advertise healthier options or compliance with dietary guidelines must ensure claims are accurate. Misrepresentation can lead to advertising injury claims under general liability policies.

Clear documentation and consistent staff communication are essential to reducing this exposure.

Supply Chain Changes and Property Risk

Sourcing alternative ingredients can impact storage requirements, refrigeration needs, and kitchen layout. Improper storage increases the risk of spoilage, equipment strain, and fire hazards.

These changes should prompt a review of commercial property coverage and equipment breakdown insurance.

For deeper insight into equipment related risks, restaurant owners can explore restaurant equipment insurance coverage Florida as part of a broader insurance strategy.

How Dietary Guidelines Influence Workers’ Compensation Exposure

Changes in food preparation standards often affect employee workflows, equipment usage, and training requirements.

New Preparation Techniques and Injury Risk

Healthier cooking methods may require additional food handling, longer preparation times, or new equipment. Without proper training, employees face increased risk of cuts, burns, and repetitive strain injuries.

Workers’ compensation claims often increase during periods of operational change. Restaurants should assess whether safety protocols have been updated to reflect new processes.

Training Gaps and Claim Denials

Insurers may scrutinize whether employees received adequate training when claims arise. Failure to document training related to new guidelines can complicate workers’ compensation claims and lead to disputes.

Comprehensive training programs are not only a regulatory best practice but also a critical insurance risk management tool.

Commercial Property and Equipment Risks Linked to Guideline Compliance

Compliance with dietary guidelines frequently requires investment in new equipment or modifications to existing kitchen infrastructure.

Equipment Upgrades and Coverage Gaps

New refrigeration units, steamers, or prep equipment must be properly scheduled on insurance policies. Underinsured equipment can result in significant out of pocket expenses after a loss.

Restaurants should review coverage for replacement cost versus actual cash value to avoid depreciation related losses.

Fire and Electrical Hazards

Additional equipment increases electrical load and fire risk. Insurers may require updated inspections or safety measures to maintain coverage.

Failure to disclose equipment changes can jeopardize claims under commercial property policies.

Importance of Specialized Coverage

Restaurants benefit from coverage tailored to food service operations, including spoilage, equipment breakdown, and utility interruption endorsements. These protections become even more important as operations evolve to meet dietary standards.

Business Interruption Risks in a Changing Regulatory Landscape

Operational disruptions linked to guideline compliance can directly impact revenue.

Temporary Closures for Compliance Updates

Menu overhauls, kitchen renovations, or staff retraining can result in partial or full closures. Without proper business interruption insurance, lost income may not be recoverable.

Policies should be reviewed to confirm coverage triggers align with realistic operational risks.

Supply Chain Disruptions

Shifts in ingredient sourcing increase vulnerability to supplier delays. Contingent business interruption coverage may help offset losses tied to supplier failures.

Restaurants that rely on specialty or healthier ingredients should evaluate whether current coverage accounts for this exposure.

Preparing for Unexpected Compliance Inspections

Regulatory inspections can temporarily limit operations. Restaurants with robust insurance coverage and documented compliance efforts can minimize financial impact while satisfying regulatory requirements.

Advanced Risk Management Strategies for Restaurants

Restaurants that proactively implement risk management strategies experience fewer insurance claims and operational disruptions. Integrating USDA dietary guideline compliance into broader risk management strengthens both regulatory alignment and business continuity.

Incorporating Dietary Compliance Into Standard Operating Procedures

Restaurants should embed compliance checks into day-to-day operations. This includes:

- Menu Audits: Regularly review menus to ensure ingredients, portion sizes, and nutritional claims match USDA guidance.

- Ingredient Tracking: Maintain detailed records of sourcing, allergens, and preparation methods.

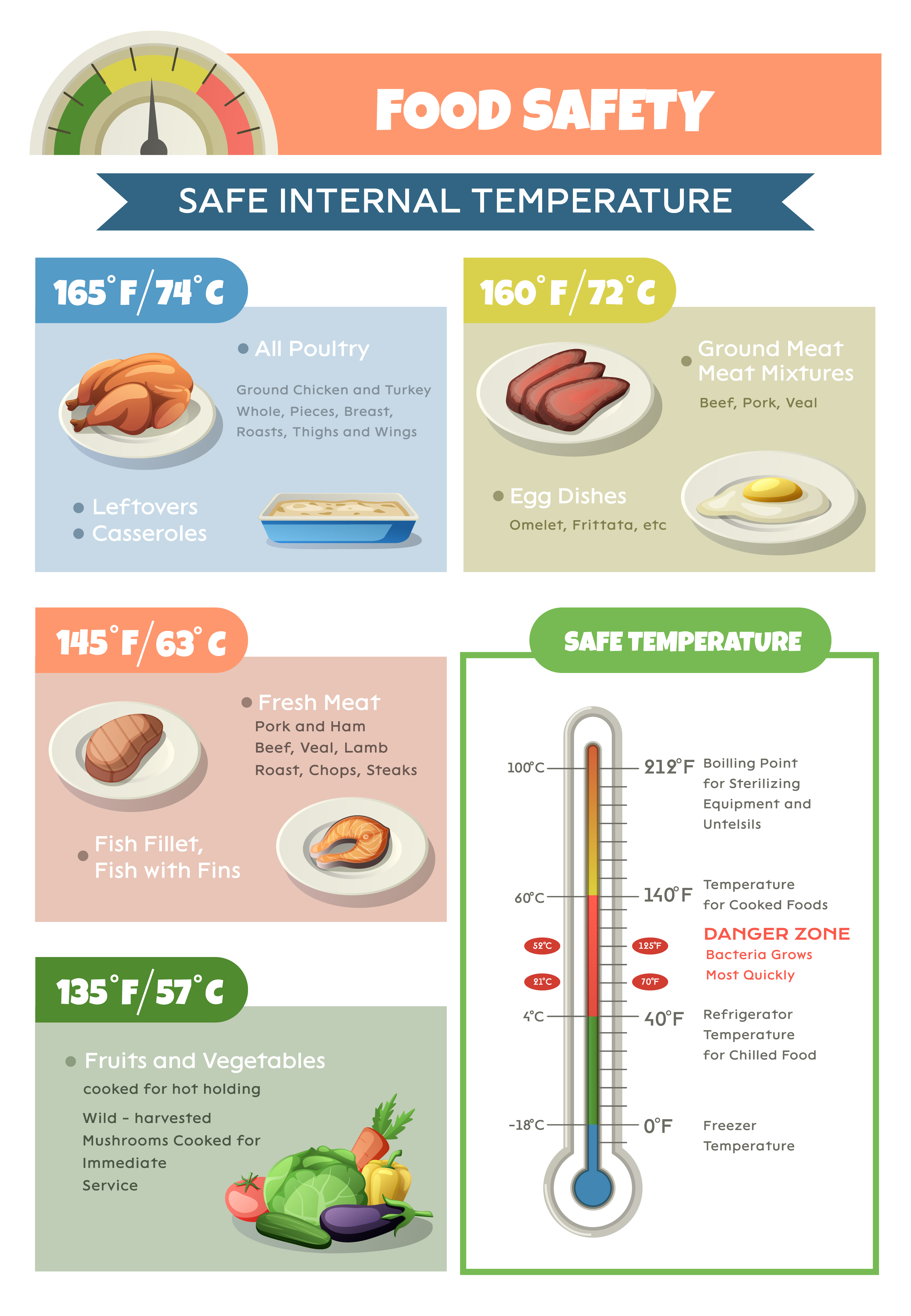

- Staff Training Protocols: Update training manuals to reflect preparation standards, allergen management, and food safety procedures.

Embedding these practices reduces liability exposure and demonstrates due diligence, which insurers consider when evaluating claims.

Proactive Safety and Equipment Maintenance

Compliance with dietary standards often involves using specialized kitchen equipment or alternative cooking methods. Restaurants can reduce risk through:

- Scheduled equipment inspections and preventative maintenance.

- Fire suppression system checks and proper ventilation for new cooking processes.

- Temperature monitoring protocols for refrigeration and storage units.

Proper maintenance not only protects employees and property but also supports insurance claims in the event of equipment failure or property damage.

Leveraging Technology for Risk Reduction

Modern software solutions can streamline compliance tracking and insurance preparedness:

- Recipe and Allergen Management Systems: Ensure ingredient accuracy and reduce labeling errors.

- Inventory Monitoring: Track expiration dates, storage conditions, and food rotation to prevent spoilage claims.

- Digital Training Platforms: Document staff education on safety and guideline adherence, which can be critical for workers’ compensation claims.

Technology integration demonstrates a proactive approach to risk management and can favorably influence underwriting decisions.

How USDA Dietary Guidelines Influence Liability Coverage

Liability exposure is often the most misunderstood area of insurance for restaurants navigating new dietary guidance.

General Liability Coverage Considerations

General liability policies protect against claims of bodily injury or property damage, but may not automatically cover incidents arising from new menu items or allergen exposure. Restaurants should confirm:

- Whether coverage explicitly includes foodborne illness claims.

- If advertising liability coverage addresses menu claims or misrepresentation of nutritional content.

- Policy limits sufficient to cover potential legal expenses and settlements.

Restaurants that update menus to meet USDA guidelines without adjusting liability coverage may face significant out-of-pocket losses in the event of a claim.

Workers’ Compensation and Employee Health

Changes in food preparation can increase injury risk. Insurance underwriters often evaluate:.

- Staff training documentation related to safe handling of new ingredients or equipment.

- Updated safety protocols for high-risk tasks, such as handling hot oils or heavy equipment.

Documenting these measures not only reduces claim frequency but also strengthens a restaurant’s position during claims review.

Lessons from Florida Restaurants

Some scenarios illustrate the USDA dietary guidelines impact on restaurants and highlights insurance implications.

Case Study 1: Menu Reformulation and Liability

A Central Florida bistro updated its menu to reduce sodium and sugar in line with new guidelines. Unfamiliar ingredients led to a customer allergic reaction. The restaurant’s general liability insurance, updated after the menu change, covered medical expenses and legal fees, demonstrating the importance of proactive policy review.

Case Study 2: Equipment Upgrades and Property Protection

A family owned cafe invested in new steam ovens and refrigeration units to meet dietary standards. Scheduled inspections and updated commercial property coverage prevented financial loss when an equipment failure occurred during peak hours.

Case Study 3: Staff Training and Workers’ Compensation

A seasonal seafood restaurant hired temporary staff to support menu adjustments aligned with USDA recommendations. Comprehensive training programs and documented procedures reduced both injury claims and insurance disputes.

These examples underscore the value of integrating regulatory compliance with insurance strategy.

Long-Term Benefits of Aligning Insurance With Dietary Guidelines

Restaurants that view insurance and compliance as interconnected gain multiple advantages:

- Reduced Financial Risk: Adequate coverage prevents losses from liability, property damage, or operational interruptions.

- Enhanced Reputation: Demonstrating proactive risk management builds customer trust.

- Regulatory Confidence: Maintaining compliance documentation and insurance alignment simplifies inspections and reduces penalties.

- Operational Efficiency: Structured procedures and technology use improve consistency, training, and staff productivity.

Proactive alignment between USDA dietary guideline compliance and insurance strategy is not a temporary measure; it is an ongoing business optimization practice.

Recommended Insurance Review Checklist for Florida Restaurants

To ensure full coverage and regulatory alignment, restaurant owners should consider the following checklist:

- Menu and Ingredient Review: Verify that all new menu items are accurately documented and communicated to staff.

- Allergen and Nutritional Documentation: Track ingredients, allergens, and nutritional claims to protect against liability claims.

- Staff Training Verification: Maintain records of all safety, preparation, and dietary compliance training.

- Equipment Inventory Update: Ensure all new and modified kitchen equipment is properly insured.

- Property and Fire Safety Checks: Regularly inspect all safety systems and maintain records for insurance purposes.

- Business Interruption Planning: Confirm coverage for temporary closures, supplier disruptions, and compliance delays.

- Policy Review and Consultation: Schedule a professional insurance assessment to confirm coverage aligns with operational changes.

Following this checklist reduces exposure and provides a clear path to meeting both regulatory and insurance requirements.

Restaurant Owners Seeking clarity and protection

In a changing regulatory environment restaurant owners are encouraged to take proactive steps:

- Contact CIS for consultations focused on restaurant specific insurance needs.

- Request a risk assessment to identify coverage gaps linked to operational and regulatory changes.

- Explore custom restaurant insurance plans designed to support Florida restaurants navigating evolving dietary standards.

By aligning compliance efforts with comprehensive insurance protection, restaurant owners position their businesses for long term stability, resilience, and growth in an increasingly complex industry.