The restaurant industry is on a remarkable upswing, with employment expected to grow by more than 200,000 net new jobs this year, bringing total employment to about 15.9 million workers, according to the NRA. This labor expansion reflects not only booming consumer demand but also ongoing challenges in recruiting and retaining staff across every restaurant segment. As operators welcome more workers onto the payroll, they must also confront the heightened risk landscape that comes with a larger workforce and increasingly complex operations.

Job growth is a positive signal for the industry, but it also brings new exposures and liabilities that can significantly impact a restaurant’s financial stability, reputation, and long‑term success. This deep dive explores the latest employment trends, the regulatory and operational implications of rapid job growth, and the critical role that comprehensive insurance coverage plays in protecting restaurants of all sizes.

Why Restaurant Job Growth Matters

The sheer size and projected growth of the restaurant labor market make this industry one of the most important segments of the U.S. economy. Restaurant and foodservice jobs account for roughly 10 percent of total U.S. employment, and the industry is expected to remain the second‑largest private‑sector employer in the nation.

This growth stems from several short‑ and long‑term trends:

- Robust consumer demand for dining experiences across fast casual, full service, quick service, and niche dining formats.

- Continued expansion of delivery and off‑premises dining.

- Demographic shifts, including younger workers entering hospitality careers and established workers migrating into service roles.

- Technological investments that make recruitment and retention easier but also require new skills and training.

As the workforce expands, restaurant operators must balance opportunities for growth with the responsibilities of managing a larger team and a more complicated risk profile.

The Operational Risks of Adding Staff

Expanding payrolls without a strategic approach to risk management can create significant vulnerabilities. For operators, the issues go far beyond wages and scheduling: every new employee adds a layer of responsibility and potential exposure.

Safety and Injury Risk with More Employees

Restaurant work involves inherently risky tasks, like lifting heavy items, operating commercial kitchen equipment, working around hot surfaces, and managing fast‑paced service periods. As staff numbers grow, so does the probability of workplace injuries, which can lead to:

- Extended workers’ compensation claims.

- Higher premium costs for insurance coverage.

- Lost productivity and morale issues.

The more employees a restaurant has, the greater its risk of injuries that could result in costly claims if protections are not in place.

Recruitment, Turnover, and Onboarding Challenges

Rapid hiring often increases turnover, especially in entry‑level positions where career commitment may be low and training time is high. High turnover creates several operational headaches:

- Frequent recruitment costs.

- Repeated training and retraining expenses.

- Risk of inconsistent service quality.

- Greater likelihood of errors and accidents.

This environment can also expose managers to personnel disputes and potential regulatory violations if hiring and HR practices are inconsistent or poorly documented.

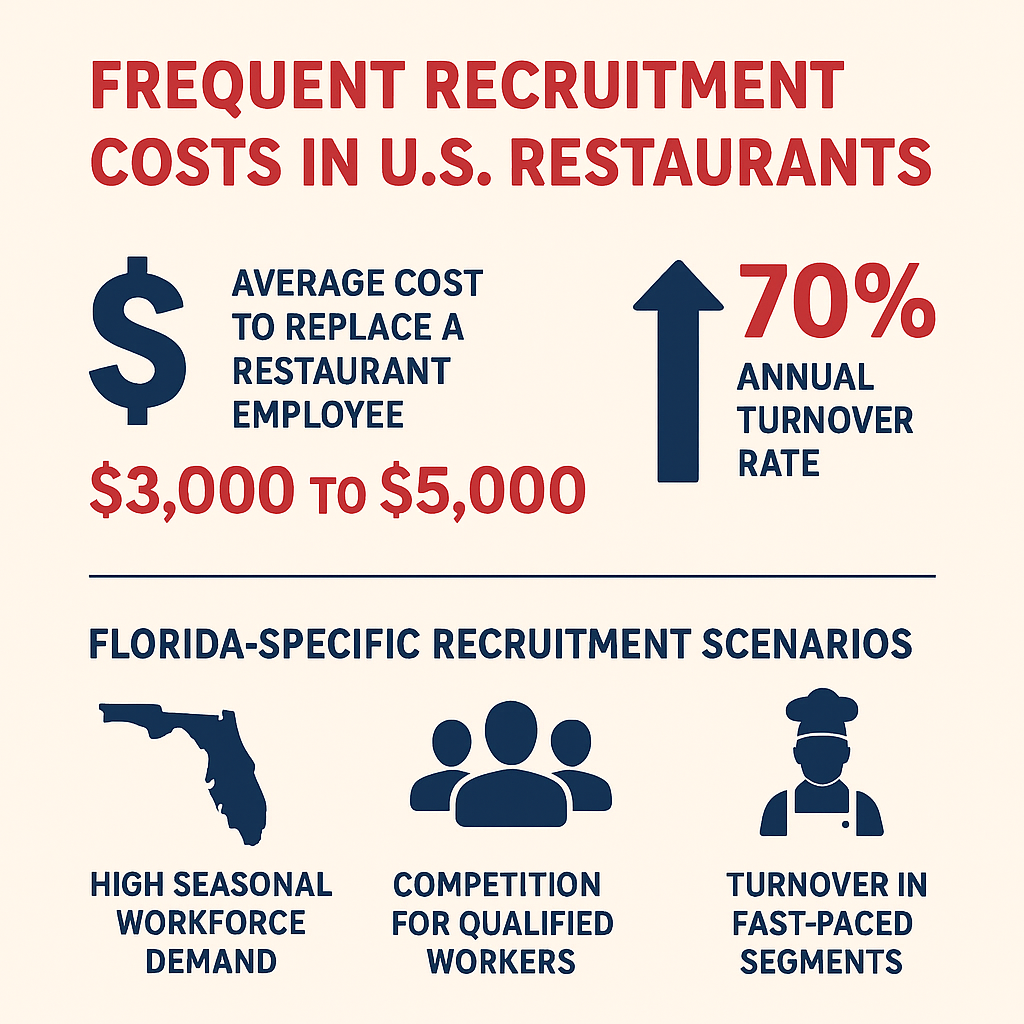

Frequent Recruitment Costs in U.S. Restaurants and Florida Scenarios

As restaurants expand staffing to meet increased demand, frequent recruitment becomes a significant operational and financial burden. Nationwide, the restaurant industry faces one of the highest turnover rates among all U.S. sectors, with entry-level positions often seeing annual turnover exceeding 70 percent. High turnover drives continual recruitment cycles, creating direct and indirect costs that can erode profitability and operational efficiency.

National Recruitment Trends

Across the United States, frequent hiring impacts restaurants in several ways:

- Advertising and sourcing expenses: Posting job openings across platforms, staffing agencies, and job boards accrues regular costs. Digital recruitment, while efficient, often requires paid promotion to attract qualified candidates in competitive markets.

- Interview and selection costs: Each candidate must be screened, interviewed, and sometimes tested or evaluated, which consumes management time that could otherwise focus on operations.

- Training and onboarding: New hires require orientation, food safety training, and on-the-job supervision. Frequent onboarding reduces productivity and increases the probability of errors or accidents during the learning period.

Industry research indicates that the average cost to replace a restaurant employee can range from $3,000 to $5,000, depending on the role, seniority, and location, making repeated recruitment a costly reality.

Florida-Specific Recruitment Scenarios

Florida presents unique considerations for restaurant operators dealing with job growth:

- High seasonal workforce demand: Tourist seasons and peak hospitality periods require rapid scaling of staff, particularly in coastal and urban areas. Operators must frequently recruit to accommodate these fluctuations.

- Competition for qualified workers: Florida’s thriving restaurant and hospitality sector, coupled with low unemployment in many counties, increases competition for skilled kitchen staff, servers, and management personnel, driving up recruitment costs and time investment.

- Turnover in fast-paced segments: Quick-service and casual dining establishments, which make up a large portion of Florida’s restaurant market, often experience higher turnover rates due to the physically demanding work and limited career progression opportunities.

Frequent recruitment without adequate planning or insurance coverage can have cascading effects. New hires increase exposure to workplace injuries and regulatory compliance requirements, and gaps in staffing can affect service quality, revenue, and employee morale.

Operators can mitigate the financial and operational impact of frequent hiring by integrating workforce planning with comprehensive insurance solutions. Coverage such as workers’ compensation, liability, and property protection ensures that each new employee’s risk is managed, even as the restaurant navigates the recurring costs of recruitment and onboarding.

Compliance with Labor and Safety Regulations

Restaurants must adhere to a complex web of local, state, and federal regulations related to labor laws, safety standards, wage requirements, and workplace conditions. As employment grows:

- Documentation and compliance burdens multiply.

- Restaurants must ensure that training covers not only job tasks but also legal requirements.

- Failure to comply with labor standards can result in fines, lawsuits, and reputation damage.

Unchecked growth without compliance is a liability waiting to happen.

Liability Exposures That Grow with Your Workforce

Restaurant operators often have a strong grasp on food quality and customer experience, but risk exposures related to employees and operations can be overlooked until it is too late. Here are the primary liability exposures that accompany job growth:

General Liability Risk

General liability coverage protects businesses from claims arising from third‑party bodily injury, property damage, and related legal defense costs. In a restaurant setting, this can involve:

- A guest slipping on a wet floor.

- An employee accidentally dropping equipment that injures a visitor.

- Damage to customer property.

With more employees on the floor, the number of interactions with customers increases, and so does the potential for incidents that lead to liability claims.

A restaurant‑industry analysis estimates that nearly 11,000 slip and fall accidents occur in restaurants every single day nationwide, which would equate to around 4 million such incidents per year when considered across the full sector. These include both customer and employee slips, trips, and falls.

Also, industry claim statistics show that slip and fall incidents continue to be a top category in hospitality insurance claims, representing roughly 12.8 percent of all restaurant insurance claims in recent reporting.

Employment Practices and HR Exposure

Larger workforces often bring elevated issues surrounding hiring, supervision, and termination practices. Without solid human resource policies and coverage such as employment practices liability insurance, restaurants may face claims including:

- Wrongful termination.

- Discrimination or harassment allegations.

- Wage and hour disputes under state or federal law.

Employment practices liability is a safeguard that many operators overlook until after a costly claim has been filed.

Workers’ Compensation Liability

When growth leads to more workers, the probability of workplace injuries rises proportionately. Workers’ compensation insurance is not just a legal requirement in most states; it is a critical safeguard that:

- Covers medical expenses and lost wages for injured employees.

- Protects the business from being sued for workplace injury.

- Helps meet regulatory compliance standards.

Failing to provide adequate workers’ comp coverage exposes restaurants to lawsuits, fines, and expensive out‑of‑pocket claims.

Commercial Property Risks in an Attendant Growth Environment

Job growth often goes hand in hand with expanded operations, new equipment, and larger facilities. As restaurants invest in upgrades or broaden their physical footprint, new property risks emerge.

Equipment Breakdown and Loss

Commercial kitchen equipment represents a significant investment, and breakdowns can disrupt operations or cause secondary damage (for example, fires). Adequate commercial property protection addresses:

- Repair or replacement costs for damaged equipment.

- Losses due to business interruption if operations must close temporarily.

Property coverage becomes more critical as labor growth demands more production capacity and reliance on equipment.

Protection from Natural and External Hazards

Restaurants are vulnerable to damage from external factors such as severe weather, flooding, or utility failures. As staffing and operations expand, the financial impact of property loss grows significantly. Coverage that includes protection against these perils ensures:

- Replacement of damaged assets.

- Support for reopening operations quickly.

- Peace of mind for operators during unexpected disruptions.

The Hidden Cost of Business Interruption

Growth can be derailed by interruptions that are outside the operator’s control, whether a mechanical failure, weather event, or supplier disruption. Business interruption insurance helps mitigate these risks by reimbursing:

- Lost income during closures.

- Fixed expenses such as rent and payroll (during covered downtime).

- Costs associated with reopening.

In a labor‑intensive business like a restaurant, even a short closure can have severe financial consequences, especially when payroll obligations persist without revenue. This coverage is an essential component of a restaurant’s risk management strategy.

Tailored Insurance Solutions for Growing Restaurants

Given the rapid expansion of the workforce and the increasingly complex operational environment, one‑size‑fits‑all insurance plans are insufficient. Operators need customized insurance solutions that account for their specific business model, size, and risk profile.

A tailored plan typically includes a combination of:

- General liability

- Workers’ compensation

- Commercial property protection

- Business interruption insurance

- Optional add‑ons for employment practices, equipment breakdown, and more

By aligning coverage with real operational exposures, restaurants can ensure that growth does not lead to crippling financial risk.

For example, restaurants seeking equipment protection in Florida can explore specialized coverage options such as restaurant equipment insurance coverage Florida that safeguard valuable kitchen assets against unexpected breakdown or damage.

Regulatory Realities and Compliance

Growing employment also means a heightened need for regulatory compliance. Restaurants must stay up to date with:

Federal and State Labor Laws

As employment scales up, the complexity of wage laws, overtime rules, mandatory breaks, and documentation requirements increases. Restaurants that are unprepared for these legal demands can face:

- Penalties.

- Back wages owed to employees.

- Increased legal costs.

Understanding and managing regulatory risk is a critical foundation for sustainable growth.

Workplace Safety Standards

The Occupational Safety and Health Administration (OSHA) and state counterparts set safety standards that apply to foodservice environments. With more staff comes greater responsibility to:

- Provide proper safety training.

- Maintain workplace safety protocols.

- Document incidents and corrective actions.

Insurance carriers often assess a restaurant’s safety program when setting rates, so a proactive safety culture can reduce premiums and improve risk outcomes.

The Business Case for Proactive Risk Management

While adding staff is essential to meet customer demand, operators must treat risk management as part of their growth strategy. The costs of under‑insuring include:

- Unexpected expenses from claims that exceed budgeted funds.

- Legal defense costs that deplete cash reserves.

- Business interruption losses that halt revenue.

- Damaged reputation from claims or public incidents.

Damaged Reputation from Claims or Public Incidents

In the restaurant industry, reputation is everything. A single negative incident (whether a slip-and-fall accident, foodborne illness, or a publicized property damage claim) can quickly spread online and damage a restaurant’s image. Customers are highly sensitive to reports of safety or service issues, and in today’s digital age, a social media post or review can reach thousands of potential diners within hours.

When a claim arises, whether it’s a liability claim or workers’ compensation incident, the public perception of your restaurant can shift dramatically. Even if your business is ultimately found not at fault, the initial negative exposure can deter repeat customers and harm new customer acquisition. Restaurateurs may face questions about safety protocols, staff training, and overall management practices.

Having the right insurance coverage is essential not only for financial protection but also for preserving trust with your patrons. Policies such as General Liability or Employment Practices Liability can help cover legal costs, settlements, and public relations efforts, giving your business the resources it needs to respond quickly and effectively. In many cases, an experienced insurance partner can guide you through incident management strategies, helping to minimize public fallout and rebuild your restaurant’s reputation.

Ultimately, proactive risk management paired with comprehensive insurance ensures that a single incident does not define your brand. Restaurants that prepare for potential claims and have a clear plan to address public concerns are far more resilient and better positioned to maintain customer confidence during challenging times.

In contrast, a proactive approach to insurance and risk planning provides:

- Financial safeguards against predictable and unpredictable events.

- Tools for compliance with evolving regulations.

- Confidence to pursue expansion without exposing the business.

Best Practices to Manage Risk With Growth

Here are actionable risk management strategies that restaurants can adopt now to protect their operations:

Conduct Regular Risk Assessments

Assessing risk areas enables owners to understand where exposures are greatest and allocate resources accordingly. Key areas include:

- Employee safety and training gaps.

- High‑traffic customer zones.

- Equipment and facility vulnerabilities.

- Administrative compliance processes.

Implement Comprehensive Training Programs

Training should extend beyond customer service to include:

- Safety and hazard awareness.

- Proper equipment use.

- Documentation of incidents and corrective protocols.

- Anti‑harassment and discrimination prevention.

Training not only reduces risk but also demonstrates an operator’s commitment to a safe and inclusive workplace.

Review Insurance Coverage Annually

As operations evolve, so should insurance coverage. Annual reviews help ensure:

- Coverage limits remain adequate.

- New exposures are not left uninsured.

- Deductibles are optimized for financial resiliency.

Use Technology to Enhance Compliance

Digital tools can help restaurants manage payroll, safety documentation, and compliance reports more effectively, reducing human error and improving reporting accuracy.

External Resources for Restaurant Employers

Operators who want to deepen their understanding of workplace compliance, business planning, and industry data can consult the following authoritative sources:

U.S. Small Business Administration

The SBA offers guidance on hiring, regulatory compliance, and small business planning that can help restaurants navigate labor and operational requirements.

Click here for more information: U.S. Small Business Administration

National Restaurant Association

The NRA provides research, advocacy, and industry insights, including employment trends, economic outlooks, and operational benchmarking data essential for planning around restaurant job growth.

Click here for more information: National Restaurant Association

Insurance Information Institute

The III is a respected resource on insurance basics, risk management strategies, and explanations of coverage types relevant to hospitality businesses.

Click here for more information: Insurance Information Institute

Restaurant Job Growth Is an Opportunity and a Responsibility

The restaurant industry’s expanding workforce reflects resilient consumer demand and positive economic momentum. Growth creates opportunities for innovation, enhanced service, and revenue expansion. But without the right risk management strategies and insurance protections in place, that same growth can expose restaurants to financial harm from employee injuries, liability claims, property loss, and regulatory penalties.

Operators who approach risk proactively with comprehensive, tailored insurance coverage position themselves to thrive rather than struggle. Understanding exposures, investing in safety and compliance, and aligning coverage with operations will empower restaurants to sustain growth with confidence.

What Operators Should Do Next

Restaurant owners and operators ready to protect their businesses as they expand should:

- Contact USA CIS for personalized consultation to evaluate current coverage and gaps.

- Request a risk assessment that aligns operations with appropriate insurance.

- Explore custom restaurant insurance plans designed specifically for foodservice businesses in Florida.

Protecting a restaurant today is an investment in its longevity tomorrow. By addressing risk now, operators can ensure that restaurant job growth becomes a cornerstone of success, not a source of vulnerability.